unified estate and gift tax credit 2021

Unified Tax Credit. Browse Our Collection and Pick the Best Offers.

Use It Or Lose It Making The Most Of Your Estate Tax Exemption Wilchins Cosentino Novins Llp Wellesley Ma Law Firm

Unified Estate And Gift Tax.

. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. You are eligible for a property tax deduction or a property tax credit only if. As of 2021 you are able to give 15000 per year to any.

The unified tax credit changes regularly depending on regulations related to estate and gift taxes. What Is the Unified Tax Credit Amount for 2022. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021.

What Is the Unified Tax Credit Amount for 2021. Any tax due is. Estate Gift Unified Credit.

NJ Clean Energy- Residential New Construction Program. Gift and Estate Tax Exemptions The Unified Credit. The Internal Revenue Service announced today the official estate and gift tax limits for 2021.

Unified credit against estate tax. A person giving the gifts has a lifetime exemption from paying taxes. For 2009 tax returns every American received an automatic unified tax credit against federal estate and gift taxes of 1455800 which is equivalent to transferring 35.

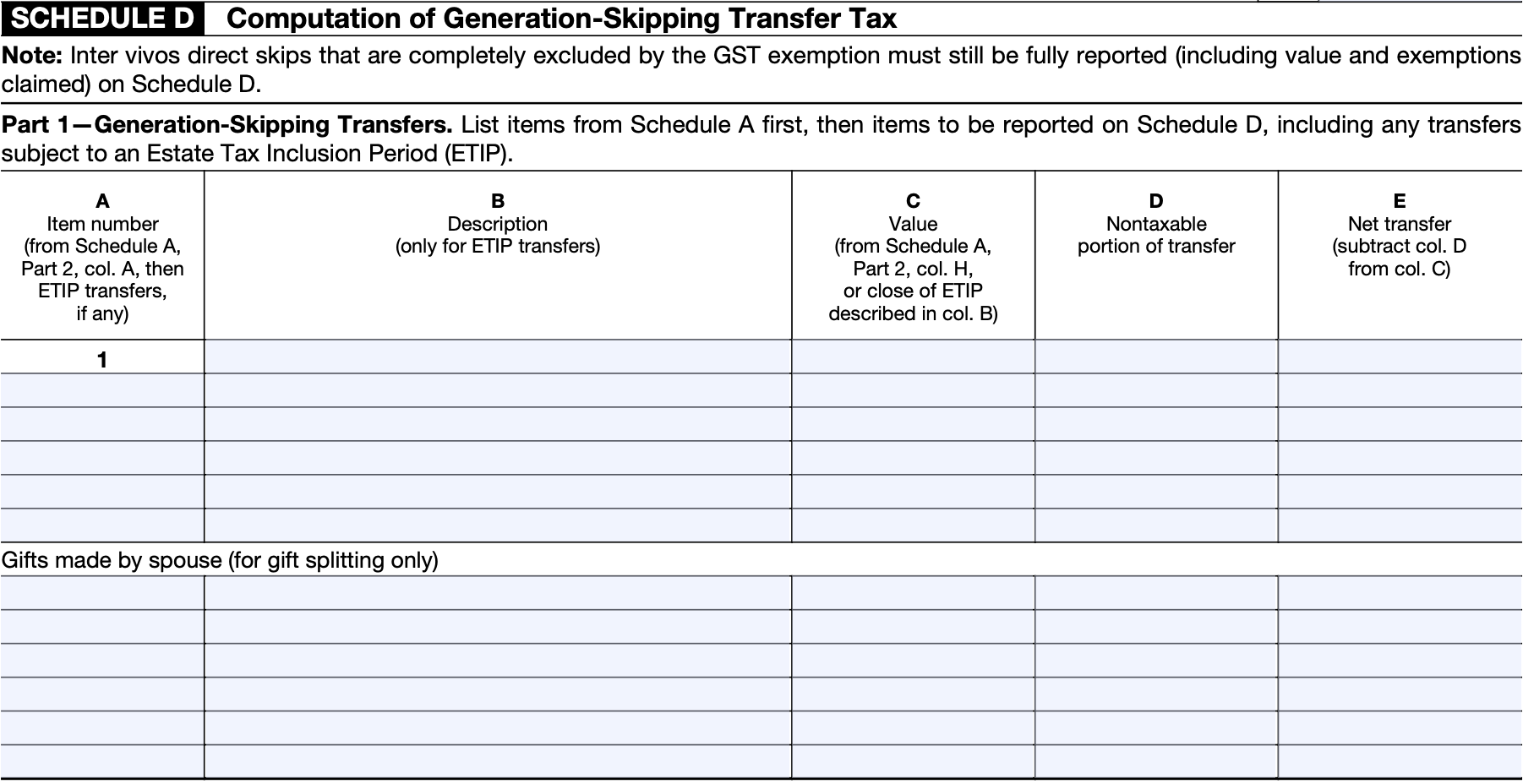

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. Estate Trust Tax Services.

The unified tax credit changes regularly depending on. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death.

If a tax on a gift has been paid under chapter 12 sec. If you were both a. The Estate Tax is a tax on your right to transfer property at your death.

Estate Trust Tax Services. Ad Committed to Delivering High-Quality Tax Services for Sophisticated Financial Needs. Learn How EY Can Help.

A unified tax credit allows you to gift assets without having to pay transfer taxes in some cases. The gift and estate tax. Incentives depend on the HERS score and the classification.

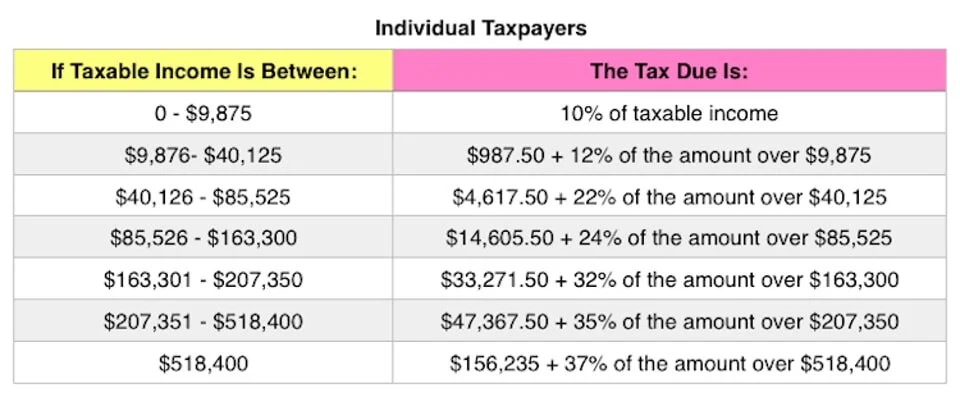

The chart below shows the current tax rate and exemption levels for the gift and estate tax. What Is the Unified Tax Credit Amount for 2021. Ad Estate gift unified credit.

Most relatively simple estates cash publicly traded securities small. Or of course you can use the unified tax credit to do a little bit of both. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

Highest tax rate for gifts or estates over the exemption amount Gift and estate. The gift tax and the estate tax. Login to your TurboTax account to start continue or amend a tax return get a copy of a past tax return or check the e-file and tax.

Check Out the Latest Info. Estates of decedents who die during 2023 have a basic exclusion amount of 12920000 up from 12060000 in 2022. A tax credit that is afforded to every man woman and child in America by the IRS.

Property Tax DeductionCredit Eligibility. Or of course you can use the unified tax credit to do a little bit of both. The unified tax credit is in addition to a gift tax exclusion an amount you can give away per person per year without dipping into the credit.

Ad Committed to Delivering High-Quality Tax Services for Sophisticated Financial Needs. If you die in 2022 after making such a taxable gift you will still be able to transfer. 1 day agoThe other big change.

Then there is the exemption for gifts and estate taxes. 16 hours agoClick Dashboard Create an app. All people are qualified to take advantage of this tax perk from the Internal.

The unified tax credit changes regularly depending on. Your available Unified Credit is effectively reduced from 1206 million to 12 million. Learn How EY Can Help.

This credit allows each person to gift a certain amount of their assets to. Indicate whether you live in a home that you owned choose Homeowner or rented choose Tenant during 2021. The lifetime estate and gift tax exemption also known as the unified credit will jump to 1292 million in 2023 up from 1206 million in 2022.

Tax Credits LLC at 45 Knightsbridge Rd Piscataway NJ 08854.

What Is The Federal Estate And Gift Unified Credit Geiger Law Office

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Gifting Time To Accelerate Plans Evercore

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

Estate Tax Current Law 2026 Biden Tax Proposal

Is There A Federal Inheritance Tax Legalzoom

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Top Estate Planning And Estate Tax Developments Of 2021

How Can I Save On Taxes By Gifting Cash To Others

How To Make The Most Of The Annual Gift Tax Exclusion Cpa Firm Tampa

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

Warshaw Burstein Llp 2022 Trust And Estates Updates

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/ScreenShot2021-12-13at8.54.47AM-3c2394da9dfc4e55b60cf32af792965e.png)